San Diego Real Estate Market Update – August 2020

Prices in San Diego shot up in July compared to last year due to extremely low inventory. The number of new listings is back to the same level as last year, but Pending and Sold listings exceeded prior year.

A balanced market is about 5-7 months of inventory. We are currently at 1.8 months, compared to 2.8 last year. It is still a seller's market.

Foreclosures

One of the most common questions I get is, "are we going to see a wave of foreclosures?" A wave of foreclosures could indicate a buyer's market due to increased inventory and distressed situations.

The Short Answer

The short answer is, yes, I think we will see some impending foreclosures which will stimulate activity. However, I don't think prices will depreciate. Buyer demand will increase as foreclosures start coming on the market. As dormant buyers get back in the market, it will balance out the supply and demand.

The Long Answer

As always, I look to the data to guide my opinions. Here's the detail.

National and Local Distressed Sales

Foreclosures and short sales were at an all time low prior to the pandemic, both locally and nationally.

San Diego Foreclosures and Short Sales

Home Values

Forty two (42%) of homes are owned free and clear. Of the remaining 58%, the average equity in a home is $177,000.

Homeowners are not going to walk away from $177,000 in equity. If they run into mortgage trouble, they are going to sell their homes, not give them up to the bank in foreclosure. Additionally, with $177,000 in equity, they will likely not have to short sell their home, which is where they owe more than the house is worth.

Because of the strong equity positions, home values should not see much, if any depreciation.

Forbearance is Lower Than Expected

An estimated 4.1M mortgages are currently in forbearance, which accounts for 7.8% of all mortgages. In other words, 92.2% of mortgages are current.

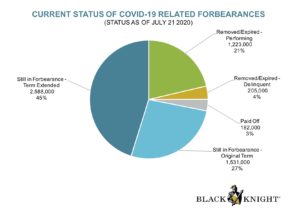

Mortgage Forbearance (as of July 21)

As of July 21, 5.7M homeowners have entered a forbearance plan. Of those that entered::

- 21% are no longer on forbearance and are current on their mortgage payments

- 4% are no longer on forbearance and are past due on their mortgage payments

- 3% paid off their mortgages

- 45% extended their forbearance

- 27% are still in their original forbearance term

In September, 2.2M forbearance plans are scheduled to expire. Therefore, we can expect to see a wave of extensions or removals in September/October timeframe. That data will become available in October/November.

- In the meantime, we can look at the last wave that expired in the June and July.

- Of the 3.8M that were set to expire in June/July, there were 1.8M extensions and 890,000 removed, which is a 2:1 ratio (as of July 21)

- If you follow that same trend, of the 2.2M in forbearance scheduled for Sept, an estimated 730,000 will be removed and 1.46M would be extended.

Home Affordability

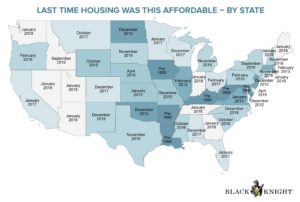

Falling interest rates are making homes more affordable. According to the Black Knight report, the last time homes were this affordable in CA was in Jan 2017.

This brings up another point that I have been making. Back in Jan 2017, it was a strong seller's market and buyers decided to wait until another market crash. In the meantime, home prices have been going up. By the time the market crashes, it may not even drop to the level it is at if you were to buy now. Here's the actual numbers for median sales prices in San Diego:

- Jan 2017 - $495,000

- Jan 2018 - $520,000

- Jan 2019 - $542,000

- Jan 2020 - $587,250

- July 2020 - $635,000

If the prices were to drop by 10% from where they are today, that would be $571,500. You would have been better off buying in January 2017 for a median priced home of $495,000. Plus, you would be paying down your mortgage instead of paying it to a landlord.

San Diego Median Home Sales Prices

Appraisals

One last thing to note is, anecdotally, I've noticed appraisals coming in low, not just in San Diego, but across the board.

In many cases, there are multiple offer situations and nearby comps that support the sales prices. Often, the appraisals get challenged and rarely do I see them succeed.

I don't think it's because prices are going down. I think appraisers and lenders are being extremely cautious. But the end result is, many times, the prices get adjusted downward in order to close the deal. Or it falls out of escrow, goes back on market and is stigmatized and eventually gets sold at a lower price. Then this suppresses the nearby home values.

Bottom Line

Overall, the market is strong. Buyers are more confident now that the peak of the pandemic has passed. Interest rates are low and it's a good time to put your home on the market. If there's anything I can do for you, let me know.